Just Jay: A Candid Chat with Jay McBain on 2020 Channel Trends and More

Part one of a two-part conversation with Jay McBain, Principal Analyst, Channel Partnerships & Alliances, Forrester

By Kristine Stewart, Vice President, Client Success and Marketing, Channel Impact

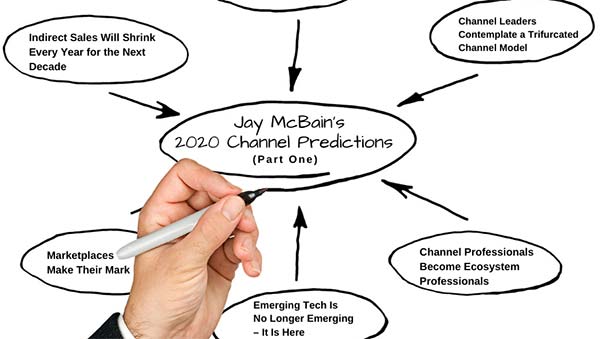

When Jay McBain, Forrester Principal Analyst, Channel Partnerships & Alliances, released his 2020 predictions in January, his commentary went viral across the industry. A highly respected visionary in our market, Jay has been known to create controversy – the kind of controversy that drives important conversations around transformation. I sat down with him recently to take a deep dive into his thought-provoking predictions and get his take on how vendors should be responding. So much insightful information was shared – about his predictions and his personal perspectives – that we decided to turn it into a two-part series.

Here are the highlights of the first part of our discussion.

Kristine: How have your predictions been received in the market? What’s the channel feedback you’ve been getting?

Jay: First off, people love the crystal ball. For 20 years I’ve been part of the World Future Society and I enjoy listening to the future of everything — what are the trends, how are they connected together, how is this all going to shape up, what does it all mean? When you can frame today based on tomorrow, things become really interesting. My blog got shared and re-shared, and also performed quite well on the Forrester site, where it is now ranked #1 for 2020 even after competing for visibility with posts on artificial intelligence, automation, drones and self-driving cars. This tells me that the topics resonated with channel professionals as well as others and got people talking and thinking.

Kristine: Of the 10 predictions, which one would you say created the most interest or caused the most reactions?

Jay: Probably the most controversial was my statement about indirect sales shrinking every year for the next decade, marking a drop for the first time in 38 years. That’s not something that channel leaders necessarily want to hear. I noted this being a result of B2B buyers reporting that they are now transacting through e-commerce, web direct, or marketplaces as consumer trends start to shift into business. Indirect technology spend will continue to grow – just more slowly than direct sales, causing the 64% split to drop each year for the next 10 years. Another point that caught people off guard was my comment about software-as-a-service (SaaS) or XaaS staying below the 30% mark for indirect sales with no signs of change.

Kristine: We’re seeing a lot now about the growth of cloud, hybrid cloud, private cloud and everything cloud. So why do you think the indirect aspect of XaaS will remain right around 30%? Why isn’t that number growing in line with cloud overall?

Jay: The number one reason is likely scale. There are 175,000 software companies making XaaS software today, and that number was 10,000, 10 years ago. That’s unbelievable, exponential growth. And 10 years from now there’s going to be a million XaaS companies. Just thinking about a million companies building out programs and recruiting partners – when there’s not even a million pure technology partners out there today – is hard to comprehend. It could come down to one partner per software company. For all these companies to make their mark to grow, they’ve got to prove themselves before they can begin to build a channel. You’ve got to get it to the point that you can “franchise” your donut, your coffee, or your hamburger to others. I ran a software company for seven years and I’ve raised venture capital so I know from experience how the process works. It takes years in most cases to really get to that point of maturity. So there’s a drag effect here in XaaS. It has been around 20 years and we would have expected it to be further along but it’s colliding with today’s new buying model. There are also other things at play. As an example, in the blog I mentioned Salesforce’s plans to double in size from $20 billion to $40 billion. And, they’re going to recruit 250,000 new partners, which sounds fantastic for the channel. But at the same time they announced that they shut down their reseller program because 100% of these new partners are going to be non-transacting.

All of the new technologies that are replacing the old technologies that were at 70 or 80% indirect are now 20 to 30%, and that’s why indirect sales is going to continue to grow but grow more slowly than direct, meaning the percentage. But in the case of indirect sales percentage, there’s $20 billion more product purchases that are going to go through the AppExchange, which is a direct buying motion. So that’s why the XaaS percentage is stagnating: you’ve got hundreds of thousands of software companies that are selling direct that are growing by double or triple digits. You’ve got AWS, Google and Azure, all growing by 30, 40 and 50%, and they will for the next decade.

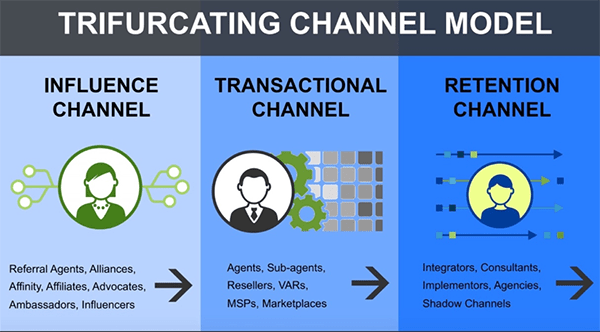

Kristine: That brings us to your prediction about the changing channel roles and the trifurcated model. That is a new concept for many channel leaders but at the same time it’s something that’s been brewing as buying models have shifted.

Jay: Exactly. For 38 years the channel has been viewed by many – from the CEO and the board on down – as transactional. It’s the gold, silver or bronze program that technology vendors have traditionally offered and the anchor for everything they’ve done around channel motions for decades.What snuck up on us was the new buyer and the new buying journey, along with the new psychology and behaviors that we’re seeing in the as-a-service market. All of these changes didn’t really align with the traditional buying or transaction cycles. So those evolutions are trifurcating the channel. And the reason I call it a trifurcated model is that there are three parts to the channel. First is the influencer channel, working with that customer up until the point of vendor selection and up until the transaction itself. Then you have the transaction model, followed by the retention model, which comes after the point of sale. A channel partner can be successful being in just one of those three phases alone, but those who will become wildly successful are the ones that figure out how to play not only in the transaction stage but to the left and the right in the influencer and retention stages. Being a partner influencer, for example, can then lead to consulting dollars and assessments. And then in post-transaction, being able to work with customers throughout the lifecycle on renewals, retention, upsell and cross-sell — that’s where the real margin is today and that’s where the real stickiness and growth is.

Kristine: Knowing that a high percentage of the buyer’s time is spent in the digital journey, it’s clear that if you’re not involved on the left side of the transaction, you may not be involved in the transaction at all. How can vendors adapt with their channel initiatives?

Jay: The stat that’s probably the scariest for channel leaders as well as other business leaders, from Fortune 500 companies on down is this: 71% of buyers who, by the way, are making two-thirds of all technology decisions today, reach vendor selection at the end of the digital journey. — without using traditional sales processes and demos. This means, if you’re a vendor, whether large, medium or small, you may have lost a deal without even knowing it. If a customer journey starts with a Google search 81% of the time, the results on page one and page two of Google are potential influencer partners because those businesses are writing the content and getting the high Google placement. In other words, they are able to earn the trust that places them in front of the customer performing the search. They’re producing the e-book, the white paper, the newsletter, the webinar or the podcast — whatever it is that inspires that customer to click through. And we know that customers in that part of the journey, the digital journey, will use upwards of five different partners to come to vendor selection. They’re just not traditional partners. They may look like alliances, affinity partners, affiliates, advocates, ambassadors or influencers. They’re different and you would rate and rank them differently and be able to measure them differently with attribution. And going forward, these are the kinds of channel relationships that vendors must turn to for getting in front of customers earlier in the journey.

Kristine: This leads to the marketplaces conversation. The obvious marketplaces are Salesforce, AWS and Google. Please speak further to these and the other types of marketplaces and ecosystems we will see.

Jay: There are actually three trillion-dollar-value companies today: Microsoft, Apple and, as of recently, Google. The interesting thing is these and other companies are being rated based on their ability to drive an ecosystem in their valuation. Here’s the way it works, using Salesforce as an example. Salesforce has less than $20 billion in revenue but they’re ranked at $170 billion on the stock market today. That’s a valuation that’s just off the charts. But guess what, it’s not their revenue that people care about, it’s their ability to drive the ecosystem. And if they add up their entire ecosystem into their AppExchange and tax it, they just doubled the size of their company on tax alone. If you look at the growth of Apple services, Apple news and Apple TV Plus and all these things they’re doing, it’s on services. They’re taxing the entire ecosystem, and this is the valuation of the future for every company.

These powerful supermarkets are now creating new roles such as marketplace SEO, community managers and ecosystem strategists. Channel leaders will need to understand the importance of these roles and adapt their business models accordingly. In fact, what may occur is that some channel professionals may ultimately become ecosystem professionals in their own right.

Kristine: Let’s pivot to another one of your predictions on emerging tech. What are the technologies for channel leaders and partners to watch this year?

Jay: As I mentioned in my blog, in 2019 many emerging tech categories turned into multi-million-dollar revenue streams for partners. As a continuation of that, in 2020 early adopters will move into an early majority for technologies such as IoT, AI, automation, 5G, advanced security, and blockchain. These are the technology areas that are reaching critical mass that vendors and partners need to pay attention to now. I would be remiss not to mention RPA, or robotic process automation. It is a combination of automation and AI and one of the foundational tools of digital transformation, as well as the fastest-growing subindustry in the technology space today.

Kristine: On a more personal note, for a guy who lives on a plane, you must have quite a few stories to tell. Where are your favorite destinations?

Jay: Travel is a big passion of mine. My family and I have been to 93 countries so far and we have a goal to hit 100. We travel with our kids everywhere and last year we went around the world for a 21-day, 15 country adventure. The next trip will probably take us to 100. We’ll be going to Antarctica to visit our seventh continent. Some places like the Congo and Iran are off limits for our kids, and we do have some stories to tell. Like the time we were in Egypt the day the revolution broke out. More than 50 people lost their lives in the town square that day. We were fortunate to get out safely and live to tell about it. Of all the places I’ve been, Cambodia and the Czech Republic are probably my favorites – beautiful places that I want to go back to and spend some time exploring.

For channel leaders, the bottom line in 2020 is this: New partners types are emerging, and they need to be vetted, recruited, onboarded, educated, trained, incentivized and motivated. Their varying requirements, along with the new XaaS economy, are driving the need for vendors to adapt their organizations, programs and platforms – across new technologies, new ecosystems and new selling models. It is a challenge unlike anything the channel has ever seen before.

Let me know how our team can help you evaluate your current organization and strategy relative to the changing market. Channel resources are our specialty at Channel Impact, and Partner Success is our signature offering.

In closing, I want to thank Jay for his time with us and for educating and enlightening our community. There was a lot more to our conversation so be sure to check out Part 2 of the “Just Jay” series in a few weeks when we discuss his take on Partner and Customer Experience, superconnectors and more.

Stay in the Know

Keep tabs on what’s happening in the channel and the impact it will have on the partner community by subscribing to Channel Impact communications.

Recent News

Search Buzz

Buzz Categories