Just Jay: Jay McBain on Life, Learnings and the New Age of Influence in the Channel

Part two of a two-part conversation with Jay McBain, Principal Analyst, Channel Partnerships & Alliances, Forrester

By Kristine Stewart, Vice President, Client Success and Marketing, Channel Impact

There’s no doubt 2020 will go down in history as one of the most challenging years on our planet. This sets an entirely new tone and sense of perspective as to what’s happening in the IT channel, where emerging technologies and XaaS transformation are ushering in a variety of unique go-to-market strategies.

To get a handle on the dynamic industry changes impacting all of us, last month I sat down with Forrester’s Jay McBain to discuss his Top 10 Channel Predictions for 2020. Our conversation took many twists and turns, and even touched on his personal quest to travel to 100 countries – a goal he is very close to reaching.

With half of Jay’s predictions covered in the first blog, below you’ll find his candid responses to my questions about the remaining five trends, along with a glimpse into some of his other life passions. But more on that later…

Kristine: Your sixth prediction is about new channel tech companies emerging in the ecosystem space. Who are the new companies that you’re talking about and what do they do to make a difference in this ecosystem and influence the channel?

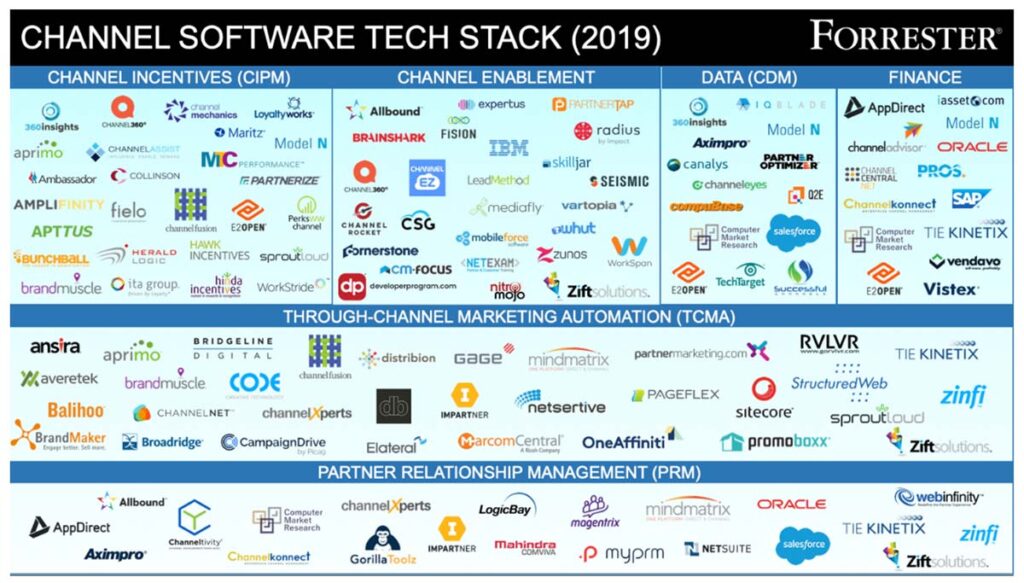

Jay: We talked last time about my 2020 predictions blog going viral. Another blog that went viral last year was my post on the Channel Software Tech Stack, a list of 106 companies that build software to help vendors automate their channel to better manage partners, market with them more effectively, drive incentives and enablement, engage in data sharing and much more. In Forrester terms, it became the second most-read blog in company history. The reason it stood out from thousands of other blogs is simple: every company in the world operates up to 75% of their business in an indirect selling model, and each one of them is trying to figure out how to do indirect better.

As I’m building out the 2020 Tech Stack list, it’s clear that this year it will likely grow to 140 companies. And there’s going to be a new category of product this year, too – ecosystems. So, to your point, what are the new companies? Think about this. What is the software you use to run an influencer channel, a transactional channel, and a retention channel – the three partner types that make up the trifurcated model we talked about last month? The answer is that the software doesn’t exist. You’ll use a Partner Relationship Management (PRM) platform for your transactional channel. But how do you run attribution for those affiliates, affinity partners, advocates, ambassadors and digital influencers that make up the influencer channel during the pre-sale stage of the customer’s buying journey? There are companies coming into B2B from other industries to fill that void in big ways. One is Impact. Their Partnership Cloud solution has worked really well in the B2C space. When Kim Kardashian is on Instagram and you pay her $1 million to wear your T-shirt and you expect to then sell $10 million worth of T-shirts because she wore it, their technology is what makes that level of influence transactable.

Kristine: So the brand ambassadors of technology have arrived in the channel?

Jay: Yes. We’re talking about bringing that whole idea of influence into the channel, but we’re not expecting Kim Kardashian to hold a Cisco product. We’re expecting 100 superconnectors to enter our space. You’re not going to pay them $1 million to run an Instagram ad, but you could spend $5,000 to get on their podcast. And you’ll be able to attribute $500,000 of revenue to that one action. Any business would line up all day long to spend that $5,000 if that’s the return. Impact raised $75 million in funding last year, and they’re now bringing their technology to the B2B space and specifically the channel. Their message to vendors will be this: you need to plug our software into your PRM and other parts of your stack to be a part of this.

WorkSpan is another example of a new channel entrant. Again, it’s non-transacting. Instead, it’s designed to run alliances effectively, which has traditionally been a real struggle because the alliance executive has no way to connect the dots. They can sign a partnership with Microsoft and get a high five from their colleagues, but five months later the question becomes, what have you done for me lately? Have we sold any routers and switches based on that? Connecting the dots between the collaborations and the deals to show results is a potential game changer because we know that the Microsoft alliance drove outcomes. We just don’t have visibility to it, and that’s what WorkSpan solves. This is an ecosystem play because whether it’s the influencer channel, the transactional channel or the retention channel, long-term it’s going to transform partner-to-partner (P2P) collaboration in terms of putting the right five partners in front of the customer and getting them working together. Workspan’s technology will allow ecosystem partners to achieve this and that’s why they’ve raised a bunch of money.

Kristine: Let’s take this back to the ecosystem and touch on its impact.

Jay: Salesforce wants to bring in 250,000 new partners in the next few years and Microsoft is adding 7,500 new partners per month. These aren’t transactional partners. They are influencer, attribution and incentive partners and they are linked to a multiplier effect for those vendors. In the Salesforce ecosystem, for example, if as one of these partner types you work to get your team certified on Salesforce, they’re going to send business your way, making your certified staff so busy that you’ll be able to charge thousands of dollars a day for their services. The relationship with Salesforce in itself is what builds the multiplier effect for that type of partner. These bigger companies have a lot of gravity.

Kristine: As you get closer to the mother ship and the gravity pulls you in, that gives you the multiplier effect of the relationship. That’s a great visual. Another emerging trend you covered in your predictions is the rising importance of the role of communities.

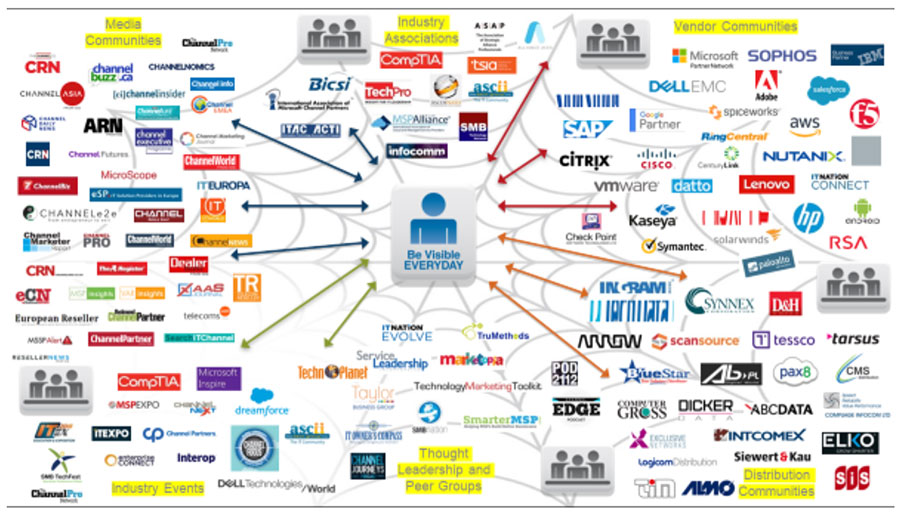

Jay: Yes, as I mentioned on my blog, the “average channel program will grow the number of partners by ten times in five years, and 80% of these new partners will be non-transacting partners. The SMB channel, which makes up over 90% of these firms, is significantly influenced by a variety of communities. For example, in the Managed Service Provider (MSP) market, there are 31 distinct communities that highly influence the 50,000 MSPs globally. Targeting these 31 communities is very profitable for many vendors.” Communities offer a small, manageable group of like-minded people who have a strong sense of belonging and are loyal to their cause. Vendors who understand this dynamic will create focused channel chiefs or community managers to tap into this loyalty.

Kristine: Prediction 7 is about Partner Experience (PX) catching up with Customer Experience (CX). So, Customer Success and Experience have become a passion of mine, so I was thrilled to see that on your list.

Jay: It’s no secret all companies are becoming customer obsessed. The light bulb is now going off at the board level and at the C-level that the business doesn’t actually own the customer relationship. That’s the case in most industries. So whatever a business is doing with its internal direct sales and marketing needs to be extended into its dealer, agent, reseller, retailer relationships because CX is very much linked intrinsically with PX. And if both aren’t working in parallel, overlapping each other, there is a huge disconnect. What’s really interesting is that I’m seeing these numbers converge, and where 43% of vendors think CX is their number one priority, 39% think PX is a top priority. We see those both reaching 50% and coming together soon.

Kristine: A year ago we had a discussion about PX and Partner Success and how often they came up in your discussions with vendors. You said it was several times a week, but the issue was, nobody was doing it well. The tech vendors were still trying to figure out how to approach it. Now here we are one year later and they are all recognizing its value. Certainly we know and can talk about people who are doing well at Partner Success, but it’s only a handful of names, right?

Jay: Very true. That was my 10th prediction: you can’t run PX in a silo. Ten years ago I figured out that you couldn’t run marketing and sales in silos — there’s too much friction. So they put them together under a Chief Revenue Officer (CRO). Well guess what? The answer to that problem of how to do this is that PX needs to be under a single leader who also owns sales and marketing. It all has to be together. For example, you can overlay your transaction-based channel organization, which has always been somewhat off to the side, onto your entire customer journey. Marketing, sales and Customer Success/Experience can then be added in. The result is an integrated, organized “nation” reporting to a single leader – the CRO. The CRO then owns everything from the top of the funnel, all the way through to the retention and renewal of your clients. That’s the model that’s going to win.

Kristine: You’ve talked about customer moments and touch points at the beginning of the digital journey all the way through the lifecycle loop of adoption, renewal, etc. Do you see any vendors getting their partners fully engaged across all those touch points? And are any of them able to provide the customer analytics to help support that engagement and synchronize those touch points?

Jay: After looking at something like 10,000 different companies, I think we’re in the second inning of the ball game here. I don’t think anybody’s closing the game right now with their relief pitcher on the mound. So, given the early innings, the areas where I see progress are really wrapped around cloud. On the infrastructure side, AWS and Azure are doing well at understanding the broader influence network. I can see it in actions like their investments in DevOps — there’s buy-in and a solid understanding of influence early in the journey. It’s also happening in some of the XaaS spaces, with Salesforce, ServiceNow, Workday, Marketo and HubSpot. There are 108,000 digital agencies, for example, in between companies like Marketo and HubSpot. Of those agencies, 78% are now doing tech services and starting to generate their multiplier effect by working with partners that are traditionally early in the journey. Looking at these buyers – two-thirds are outside of IT.

Kristine: It’s just incredible to think about the changes in the past few years surrounding the B2B buyer, but let’s save that conversation for another day. To close off our discussion with a different topic, let’s talk on a more personal level. Besides travel, what are some of your personal passions?

Jay: Well, I do play hockey three times a week. That’s a big passion of mine, along with sailing. My family owns a boat and we’ve navigated thousands of miles of waterways. We’ve been to every major city on the East Coast, including Washington, D.C., New York, Boston, Nantucket, Martha’s Vineyard, Baltimore, Philadelphia, Detroit, Toronto and Montreal. And, of course, all over the coast of Florida. We’re in the top 1% of people who have literally boated thousands and thousands of miles. When I retire, we’re going to sail across the Atlantic, from the Caribbean to the Rock of Gibraltar.

Now that’s a lot of boating … I might need to consider being a stowaway.

Speaking of boating, let me know how our team can help you navigate your current channel strategy in this stormy market. We offer a full range of channel services and talent at Channel Impact, including a Partner Success practice that many of today’s top vendors are engaging with us on.

I want to once again thank Jay for his time giving us a special deep dive into his predictions. If you didn’t read about our first conversation, be sure to check out Part 1 of the “Just Jay” series, where we covered XaaS, the trifurcated channel model, marketplaces and much more.

Update: Check out Jay’s recent blog, “Quantifying Coronavirus (COVID-19) For The Technology Channel.” He shares potential scenarios that the technology sector may experience, the accelerating evolution of channel business models and his thoughts on the new “channel normal.”

Stay in the Know

Keep tabs on what’s happening in the channel and the impact it will have on the partner community by subscribing to Channel Impact communications.

Recent News

Search Buzz

Buzz Categories